Federal Credit Report Unions: Your Secret to Better Financial

Federal Credit scores Unions offer a special method to banking that prioritizes their members' economic wellness. Allow's discover the vital benefits that make Federal Credit report Unions your entrance to far better financial options.

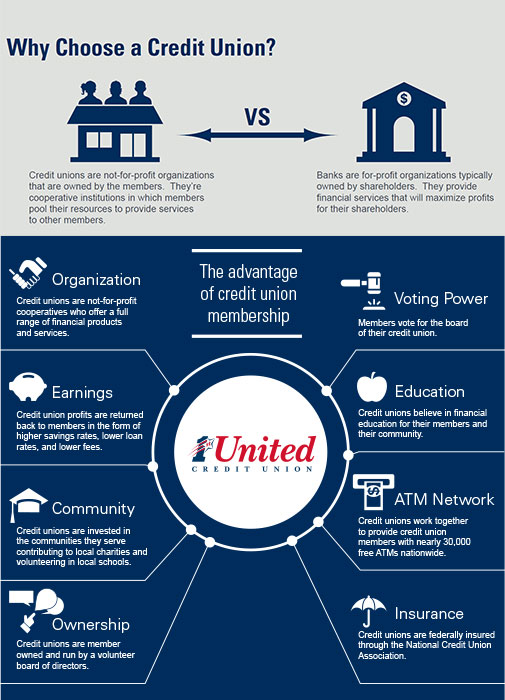

Benefits of Federal Debt Unions

Federal Credit scores Unions provide an array of advantages for members looking for a more community-oriented and personalized financial experience. Furthermore, Federal Credit score Unions are understood for their commitment to economic education and therapy.

Federal Credit history Unions often have strong connections to the regional area, sustaining little services, charities, and efforts that profit their participants. Overall, the advantages of Federal Credit scores Unions develop an extra comprehensive and supportive financial setting for those looking for a tailored and community-centered method to fund.

Member-Focused Services Supplied

With a strong focus on participant satisfaction and monetary health, Federal Cooperative credit union give a diverse variety of member-focused solutions customized to satisfy individual requirements. These specialized services exceed typical financial offerings to guarantee that members obtain customized attention and assistance in achieving their financial goals. One vital solution provided by Federal Lending institution is financial therapy and education. Participants can gain from skilled advice on budgeting, conserving, and investing, assisting them make notified decisions concerning their cash administration. Furthermore, Federal Credit Unions often offer accessibility to special member benefits such as discounted prices on fundings, higher rates of interest on financial savings accounts, and waived charges for sure transactions. One more crucial member-focused solution is customized account administration, where participants can get tailored aid based on their special financial scenarios. By prioritizing member requirements and providing tailored solutions, Federal Credit report Unions stand apart as organizations committed to giving superior banking experiences for their members.

Competitive Rates and Fees

Furthermore, Federal Credit history Unions usually have less and reduced charges for investigate this site services such as over-limits, ATM use, and account maintenance, making them a cost-effective alternative for individuals looking for economic solutions without too much fees. By prioritizing the economic wellness of their members, Federal Credit Unions continue to stand out as a cost effective and trusted financial option.

Financial Goals Achievement

An essential Read Full Report facet of taking care of personal funds properly is the successful achievement of financial objectives. Setting obtainable and clear economic objectives is essential for people to function in the direction of a protected monetary future. Federal lending institution can play an important duty in assisting members accomplish these goals via various monetary products and solutions tailored to their requirements.

One common economic goal is saving for a major acquisition, such as an automobile or a home. Federal credit rating unions offer affordable financial savings accounts and financial investment alternatives that can assist participants expand their cash in time. By working closely with participants to recognize their goals, credit history unions can provide customized recommendations and remedies to promote financial savings purposes.

An additional crucial economic objective for several people is financial debt settlement. Whether it's student finances, bank card debt, or various other liabilities, government cooperative credit union can use consolidation lendings and debt management techniques to assist participants settle financial debt effectively. By reducing rate of interest prices and simplifying repayment schedules, credit scores unions support members in accomplishing economic liberty and security.

Why Choose a Federal Cooperative Credit Union

Federal debt unions stand out as advantageous monetary organizations for people looking for a more personalized technique to banking services customized to my link their specific requirements and monetary goals. Furthermore, federal debt unions typically use lower fees, affordable interest prices, and an extra customer-centric method to service.

Verdict

Finally, Federal Credit history Unions provide a member-focused technique to banking, providing competitive prices, personalized services, and assistance for accomplishing monetary goals. Cheyenne Credit Unions. With greater rates of interest on interest-bearing accounts, reduced passion prices on fundings, and less costs than standard financial institutions, Federal Credit scores Unions stick out as a economical and customer-centric choice for individuals looking for much better banking choices. Select a Federal Credit Scores Union for a more monetarily protected future

Federal Credit Unions supply an unique method to financial that prioritizes their participants' economic well-being. By prioritizing member requirements and supplying tailored solutions, Federal Credit scores Unions stand out as institutions devoted to giving top-notch financial experiences for their members.

By prioritizing the monetary wellness of their members, Federal Credit Unions continue to stand out as a trusted and inexpensive financial alternative.

Whether it's trainee lendings, credit history card financial debt, or other obligations, federal credit score unions can offer debt consolidation car loans and financial obligation administration techniques to assist members pay off debt successfully (Wyoming Federal Credit Union).Federal credit unions stand out as helpful economic establishments for individuals seeking an extra individualized approach to financial services customized to their particular requirements and financial goals